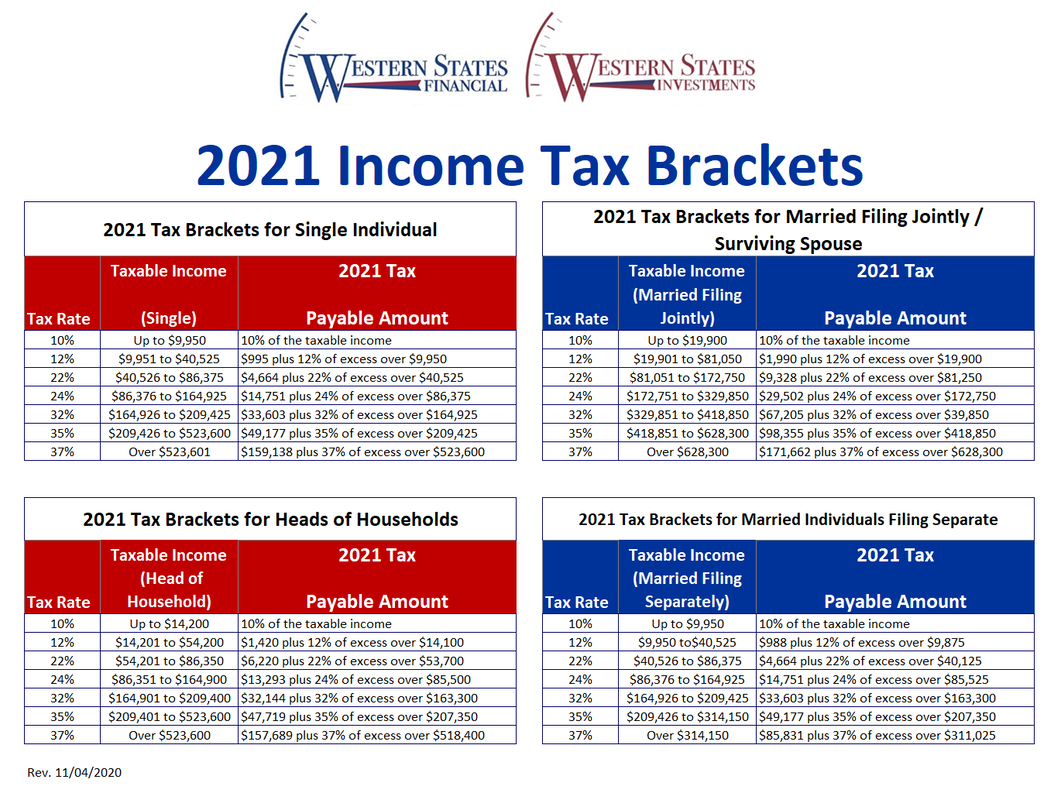

The agency said its also boosting the standard. If you file as a single and had adjusted gross income of 85,000 in 2021, you pay: a 10 tax on the first 9,950 a 12 tax on the next amount, up to 40,525 and a 22 tax. If you file your 2021 tax return as a single and had a low adjusted gross income of 9,000 last year, your tax rate is 10. You will pay 10 (previous tax bracket) on the amount up to 19,900 and 12 on the amount over 19,900. The IRS said the personal exemption will remain at 0, the same as in 2021 the personal exemption was eliminated in the Tax Cuts and Jobs Act. Heres how the tax brackets will work this year. If you do not claim Marriage Allowance and you or your partner were born before 6 April 1935, you may be able to claim Married Couple’s Allowance. For instance, if you fall in the tax bracket of 19,901 to 81,050 that levies a tax rate of 12, you will not pay a straight 12 tax. You may be able to claim Marriage Allowance to reduce your partner’s tax if your income is less than the standard Personal Allowance. If you’re married or in a civil partnership

#IRS 2021 TAX BRACKETS HOW TO#

You may be able to claim Income Tax reliefs if you’re eligible for them. Here we’ll go over the new IRS federal tax brackets for the 20 tax years, how to figure out which ones you fall into, and give you a heads up about any other inflation-related changes to your taxes in 2022. You pay tax on any interest, dividends or income over your allowances. your first £1,000 of income from property you rent (unless you’re using the Rent a Room Scheme)įind out whether you’re eligible for the trading and property allowances.your first £1,000 of income from self-employment - this is your ‘trading allowance’.You may also have tax-free allowances for:

For example, if you’re a single tax filer who made 40,000 in 2021, you’ll pay a 10 tax on the first 9,950 you made and 12 of the amount ranging from 9,950 to 40,000 when you file in 2022. dividends, if you own shares in a company The federal government breaks your income up into chunks, and you pay a different tax rate for each chunk.how much you’re likely to pay for the rest of the year.how much tax you’ve paid in the current tax year.You do not get a Personal Allowance on taxable income over £125,140. You can also see the rates and bands without the Personal Allowance. The conservative Heritage Foundation calculated that the typical American family will be about $45,000 better off over the course of the next 10 years because of higher take-home pay and a more robust and sovereign economy.Income tax bands are different if you live in Scotland. Where To File For all estates and trusts, including charitable and split-interest trusts (other than Charitable Remainder Trusts).

Under the Trump tax cuts, the average family of four making $73,000 a year saw a 60 percent reduction in federal taxes, approximately $2,058. However, the estate or trust must show its 2022 tax year on the 2021 Form 1041 and incorporate any tax law changes that are effective for tax years beginning after 2021. That deduction will be $18,800.ĭemocrat Joe Biden has said, both in the debates and on the campaign trail that he will rescind the Trump tax cuts.īiden / Harris want to eliminate the Trump tax cuts, which means: a smaller capital stock, lower labor productivity, lower wages, and lower total output for businesses, reduced ownership of capital assets & reduced savings for individuals The 2021 tax brackets are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37. There will also be an increase in the deduction heads of households can take. Meanwhile, for short-term capital gains, the tax brackets for ordinary income taxes apply. In 2021 the standard deduction is 12,550 for single filers and married. In 2020 the standard deduction is 12,400 for single filers and married filing separately, 18,650 for head of household, and 24,800 for married filing jointly. I couldn’t find a side-by-side comparison wi-th 2020, so I decided to create one that I could look at and that will hopefully help you out. Selected Income and Tax Items for Selected Years (in Current and Constant Dollars), Tax Year 2017. The standard deduction is a dollar amount that reduces your total taxable income. For married couples or those filing jointly, the deduction jumped to $25,100. The IRS released the 2021 Tax Rate Brackets recently, along with the 2021 Standard Deduction amount and a bunch of other details that your tax man might find interesting. For those filing as individuals the deduction rose to $12,550. The IRS has, in addition, adjusted the “standard deduction,” which is the deduction used to create a baseline for what is taxable in your income. 10 percent for incomes of $19,900 or less.

0 kommentar(er)

0 kommentar(er)